Tesla’s Price Adjustments in Canada. Prices skyrocketed, sales screeched to a halt, and Canadian Tesla buyers were left wondering if they’d ever see affordable EVs again. Then—almost overnight—Tesla slashed the Model Y by a staggering $20,000, rewriting the market playbook in the process. This is the story of how Tesla’s price adjustments in Canada, a tariff war, and a bold supply shift to Germany turned the country’s EV market upside down.

TL;DR (Key Takeaways)

- Tariffs whiplashed prices: Canada imposed 25% tariffs on U.S.-made imports on March 13, 2025, while 100% tariffs on China-built EVs were already in place from 2024. Canada.caASIL

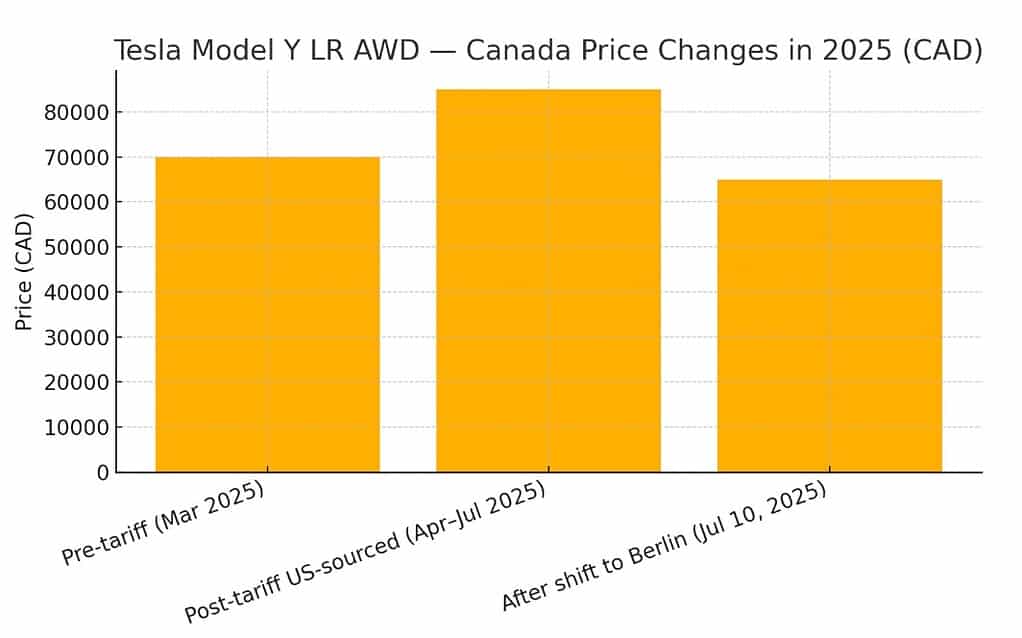

- Model Y price path: Pre-tariff Model Y LR AWD was C$69,990 → rose to C$84,990 after U.S. tariffs → dropped to C$64,990 on July 10 when Tesla began supplying Canada from Giga Berlin. Drive Tesla

- Sales cratered, then course-corrected: Canadian Model Y sales “basically went to zero” during the tariff spike; the German supply pivot reversed the trend with a C$20,000 cut. ElectrekDrive Tesla

- Where Canada’s Model Y comes from now: Predominantly Giga Berlin (Grünheide); deliveries listed Sept–Oct—longer than U.S. sourcing, consistent with trans-Atlantic logistics. Drive Tesla

What changed—and when?

Canada’s 25% tariff on U.S. goods (including vehicles) took effect March 13, 2025 as part of a C$29.8 b retaliatory package. This landed on top of Canada’s 100% tariff on Chinese EVs announced in 2024. The result: a one-two price punch on the most common Model Y supply routes (U.S. assembly) and the contingency route (China). Canada.caASIL

Related Topic: Tesla Model Y Performance to be released soon

Why this matters for Tesla

- U.S.-built cars (Fremont, Austin): subject to Canada’s new 25% tariff.

- China-built cars (Shanghai): effectively priced out by 100% tariff.

- EU-built cars (Berlin): not hit by those tariffs; CETA rules lower friction for Canada-EU trade—making Berlin the logical valve to open.

My take: The minute Ottawa’s 25% rate hit, Berlin became Tesla’s least-resistance path to save Canada demand, even if it adds weeks of lead time.

Related Topic: New Tesla Facility Grand Opening in Port Coquitlam

The price roller-coaster (with real numbers)

On July 10, Tesla chopped C$20,000 off Model Y LR AWD in Canada, taking it from C$84,990 down to C$64,990—C$5,000 below the pre-tariff price of C$69,990 noted earlier in 2025. Multiple outlets linked the cut to a sourcing switch to Giga Berlin.

Table — Model Y LR AWD price points in 2025 (Canada)

| Period (2025) | Price (CAD) | What changed | Source |

|---|---|---|---|

| Pre-tariff (early Mar) | 69,990 | Baseline before Canada’s 25% U.S. tariff | Drive Tesla |

| Post-tariff (Apr–Jul) | 84,990 | U.S.-sourced units reflect 25% tariff | Drive Tesla |

| After Berlin pivot (Jul 10) | 64,990 | Switch to Giga Berlin supply cuts C$20k; under pre-tariff level | Drive Teslaelectrive.com |

Chart: Model Y LR AWD — Canada Price Changes in 2025

Note on demand: During the spike, Canadian sales “basically went to zero,” per Electrek; the price cut is Tesla’s path to reboot demand. Electrek

Where Canada’s Model Y is coming from now (and why)

Short answer: Giga Berlin (Grünheide)

- Drive Tesla Canada reported Canada’s online configurator listing C$64,990 with Sept–Oct deliveries, “an unusually long period compared to…U.S. builds,” and argues the car is now Germany-sourced. Drive Tesla

- European trade rules + Berlin’s Model Y-only output make the switch clean and scalable, also echoed by Electrive, Notebookcheck, and Insauga. electrive.comNotebookcheckINsauga | Ontario Local News Network

- Drive Tesla’s follow-up yesterday: no Model Y inventory yet in Canada; Berlin shipments expected “in the coming weeks.” Drive Tesla

Why Berlin over Fremont/Texas or Shanghai?

- Fremont/Texas (U.S.) → hit by Canada’s 25% tariff. Canada.ca

- Shanghai (China) → hit by Canada’s 100% EV tariff. ASIL

- Berlin (EU) → not subject to those Canada measures; production is already optimized for Model Y.

Related Topic: Tesla Model Y Launch Edition

Did tariffs alone do this? The demand side story

- Tariff shock → price spike → demand stall: The April–June period saw sticker shock; Electrek describes Canadian Tesla sales as “basically zero.” Electrek

- Pivot → aggressive price reset: Multiple outlets clock the C$20k cut as a deliberate tariff work-around by rerouting supply to Berlin. electrive.comAutoblogNotebookcheck

- Inventory dynamics: Canada briefly relied on pre-tariff stock (sold down), then hit a gap while Berlin pipeline filled—hence today’s Sept–Oct ETA. Drive Tesla

My take: The pricing whiplash isn’t just politics; it’s logistics. Once Berlin allocations stabilize, I expect steadier pricing bands (with occasional paint/option promos), not the wild swings we saw in spring.

Canada vs. USA pricing—how big is the spread?

Even after the cut, Canadian pricing often looks higher than sticker-to-sticker U.S. prices after exchange—but currency, fees, and taxes complicate casual comparisons. The more relevant factor now is tariff exposure: U.S.-built units would carry an extra 25% into Canada, while EU-built units avoid that specific surcharge. Canada.ca

What to tell readers: If you’re cross-shopping U.S. vs. Canada, compare delivered prices (destination, doc fees, province taxes), and confirm build origin because that determines tariff path.

Buyer playbook (2025, Canada)

1) Confirm origin. Ask your advisor or check the VIN country code (WMI). For now, assume Berlin unless Tesla explicitly flags U.S. supply. (Drive Tesla Canada suggests Berlin is the default pipeline at the moment.) Drive Tesla

2) Expect longer ETAs. Berlin-sourced orders show Sept–Oct windows; plan around that. Drive Tesla

3) Watch for option tweaks. Tesla added Diamond Black paint with the big price drop—small changes can signal batch allocation shifts. Drive Tesla

4) Don’t sleep on incentives—but read the fine print. Provincial programs vary and can change quickly; monitor official sites and major EV publications for updates.

5) Consider timing vs. volatility. Prices may stabilize once Berlin flow normalizes; if you can wait a few weeks, you may secure the same price with shorter ETAs later in the fall.

Investor & industry angle (short)

- The Canadian turnaround shows Tesla’s supply agility—shifting continents to neutralize policy shocks.

- It also hints at regional margin engineering: Berlin output + logistics can still pencil out if it keeps lines running and market share intact.

- Watch whether other models (3/S/X) see EU pipeline experiments if tariffs persist; Drive Tesla notes no similar cuts there yet. Drive Tesla

FAQs readers will ask (add this as a collapsible on WP)

Q: Will Canada go back to U.S.-built Model Y soon?

A: If trade tensions ease or if Tesla negotiates a carve-out, maybe—but meanwhile, Berlin works and keeps price under the psychological C$65k line for LR AWD. Drive Tesla

Q: Are Chinese-built Teslas coming back?

A: Not unless policy changes; 100% tariff is prohibitive. ASIL

Q: Why were there “no cars” for weeks?

A: The pre-tariff inventory sold through; the Berlin pipeline had to spool up. Current guidance: new shipments in weeks. Drive Tesla